Energiswap FAQ

What is Energiswap?

Energiswap is a decentralized exchange and crypto swap protocol built on the Energi blockchain. With Energiswap, users can swap ERC20-compatible tokens for other ERC20-compatible tokens and a variety of synthetic assets at very low cost. Energiswap benefits directly from the speed and scalability of the Energi Gen 3 blockchain, as well as Energi’s dedicated cybersecurity and 24/7 support teams. This makes Energiswap one of the most secure, scalable, and user-friendly decentralized trading experiences on the market.

What fees are charged on Energiswap?

There are two types of fees charged for using Energiswap:

Trade Fee: Energiswap charges a 0.3% fee for every trade. The fee collected is proportionally shared with all liquidity providers. The fees are paid out when liquidity is removed from the pool.

Gas Fee: The Energi blockchain also charges a gas fee for every transaction. The fee is dependent on how busy the network is at the time of the transaction. The gas fee can be changed. A lower gas fee will affect the time to commit the transaction to the network, which could void the trade. The gas fees are much cheaper on Energi than on Ethereum, for the time being.

What is a liquidity pool?

A liquidity pool is a collection of funds locked in a smart contract.

They are used to facilitate decentralized trading, lending, and many other functions.

What is a liquidity pool token?

Whenever liquidity is deposited into a pool, unique tokens known as liquidity tokens are minted and sent to the provider’s address. These tokens represent a given liquidity provider’s contribution to a pool. The share of the pool’s total liquidity provided by the user will determine the number of liquidity pool tokens distributed to them.

What is a liquidity provider?

Liquidity providers provide equal WNRG and ERC-20 token values to prevent price slippage. In return, liquidity providers are offered rewards in the form of transaction fees, which are split equally between all current providers in the pool.

Can I trade and manage liquidity from info.energiswap.exchange?

Trading and managing liquidity is only possible on the actual interface.

While you are on the info page, simply click the Energiswap.exchange link in the bottom left to go to https://app.energiswap.exchange.

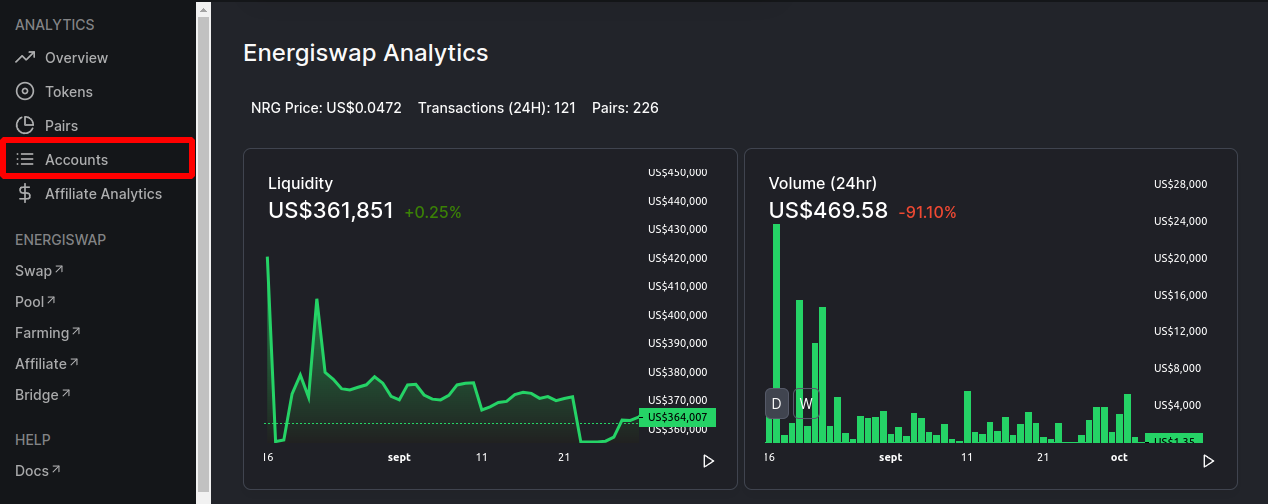

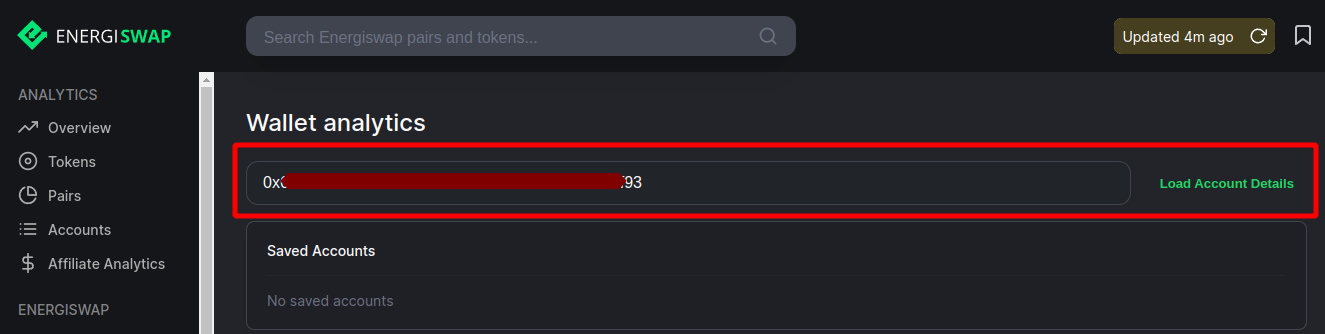

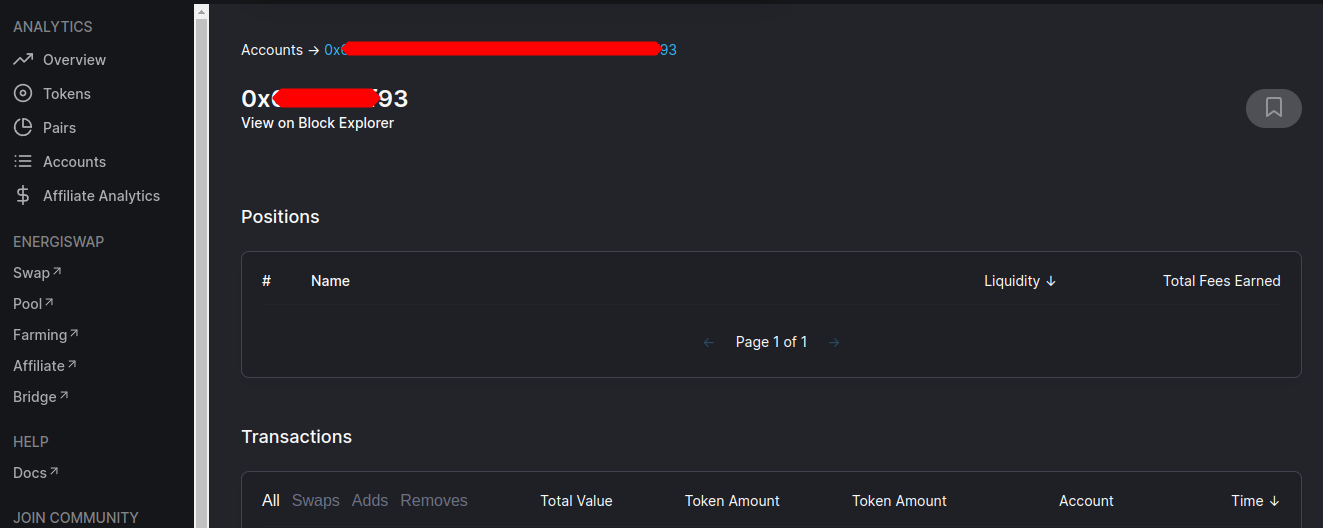

How can I look up my cumulative earned fees?

Go to https://info.energiswap.exchange and click on “Accounts” in the navigation panel. On the accounts page, enter your wallet address in the search bar at the top to look up your account.

How can I reduce my transaction fees?

You can’t reduce your transaction fees.

The liquidity provider fee is automatically calculated and set by the pools.

How does Energiswap work?

Like the protocol it’s based on, Energiswap functions as a decentralized exchange for swapping any ERC20-compatible token with any other ERC20-compatible token. Using the constant product equation, Energiswap manages liquidity pools of token pairs to allow them to be traded. This removes the need for buyers and sellers to generate demand, locking the pair into a price match determined by the available liquidity that allows for tokens to be easily swapped directly with each other.

This system also helps to combat the liquidity problem that many decentralized exchanges face. In addition to swapping tokens, users can also provide liquidity to the pool for a token by locking down equal amounts of NRG and the token. As an incentive, liquidity providers receive a distribution of the fees generated by trades. This ensures that there is always adequate liquidity in the marketplace.

We have launched Energiswap with a limited selection of tokens available for trade: eDAI, eBTC, eETH, and wrapped NRG (WNRG). eDAI is a synthetic version of the DAI stablecoin that maintains a value of ~$1.00 USD. eBTC and eETH are synthetic versions of BTC and ETH on the Energi blockchain. Users will be able to swap NRG to wrapped coins at a much lower cost than existing decentralized exchanges.

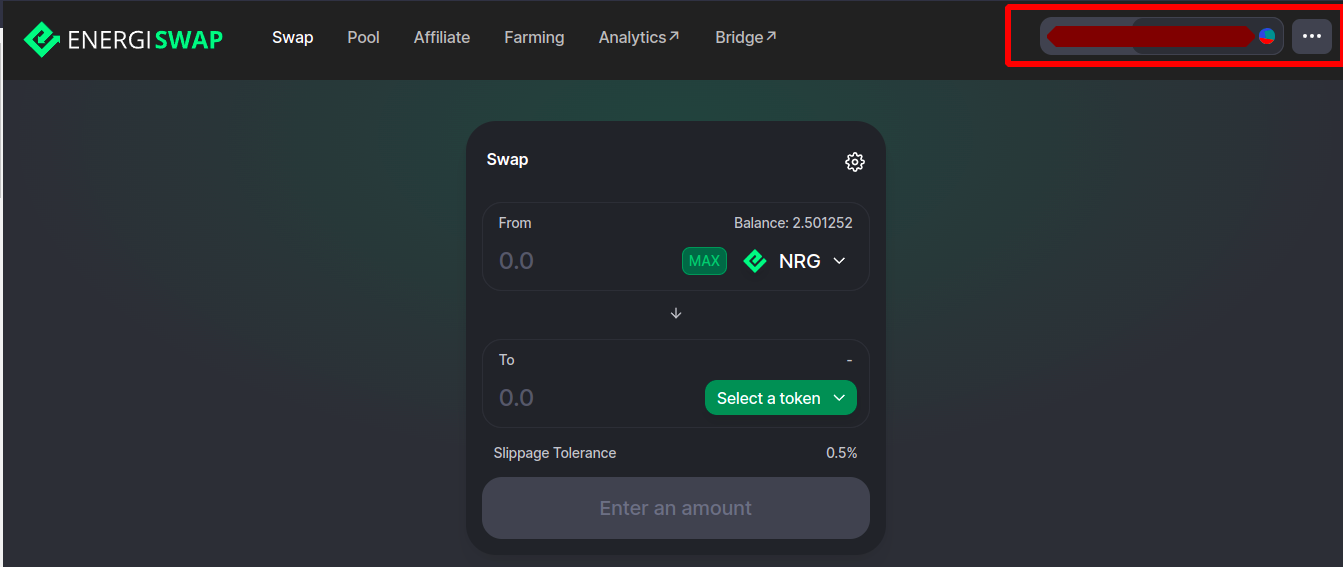

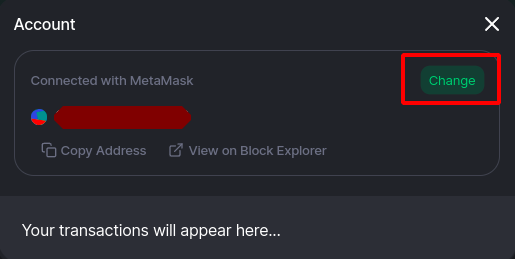

How do I change from an existing wallet to a different wallet?

Click on your wallet address displayed in the top right corner of the dashboard.

A dialog box will appear that will say ‘Connect to [current wallet]’. Just to the right of that you will find a green button that says ‘Change’. Click on it and you can choose a new wallet.

What is price slippage?

Slippage is the difference between the expected price of a trade and the actual price of the trade at execution. Slippage becomes more likely when there is a higher level of volatility in the market.

It is also more common when large orders are triggered while there is not enough volume at the selected price to maintain the current bid/ask spread. The bid/ask spread refers to the difference between the ask and bid prices of an asset at any given time.

What is a wrapped asset?

A wrapped asset is a token that exists on a single blockchain to represent the price of a different underlying asset. The wrapped token is matched via smart contract to an equal value of the underlying asset that is locked to create the wrapped token. This ensures that the value of the token is always accurate.

The main value of wrapping assets is reducing transaction time and cost, because wrapped tokens only exist on one blockchain. This means that Decentralized Apps (DApps) can process transactions for a wide array of assets via their wrapped counterparts without interacting with multiple blockchains.

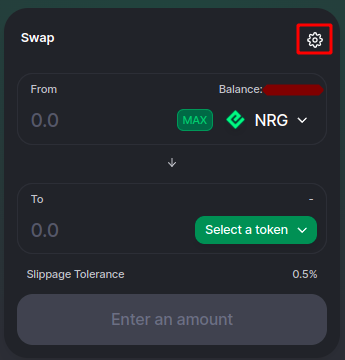

Can I reduce the slippage?

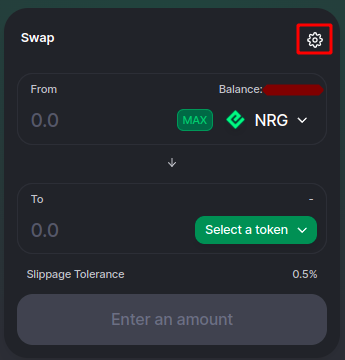

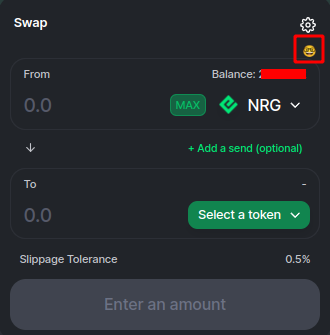

You can’t reduce price slippage. However, you can prevent trades from occurring if the price has slipped beyond a threshold. Slippage tolerance can be adjusted from the settings icon, which can be found in the top right of the interface.

What assets can be traded in Energiswap?

The initial assets that can be traded are Wrapped NRG (WNRG), DAI, BTC, ETH.

More assets (synthetic and crypto) will be added in the future.

How can I see which pools would be best to provide liquidity to?

You can find a breakdown of all the pool data here: https://info.energiswap.exchange.

Is MetaMask the only wallet option for Energiswap?

We have instructions on MetaMask and Brave wallets.

Initially we will only be able to offer technical support on these two wallets. However, you should be able to connect any web3 wallet with Energiswap.

NOTE: Currently the Energi Bridge does not support transactions made using Brave's Crypto Wallet. We recommend using MetaMask for any Energi Bridge related transactions.

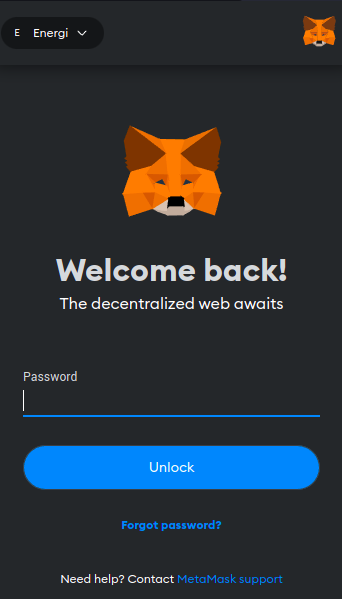

I am trying to connect my MetaMask to Energiswap, but I receive a network error. What should I do?

Connect MetaMask to the Energi blockchain.

Your account should have NRG to swap tokens.

I just swapped a token but i do not see it on MetaMask.

Select Metamask icon and unlock your wallet. Select the “Assets” tab, scroll all the way to the bottom and select “Add Token”. Select the “Custom Token” tab and paste the contract address into the “Token Contract Address” field.

If the rest of the data is not auto-populated in the other fields, fill it in as well. Select “Next”, confirm the token is correct, then select “Add Token”.

The token should now appear in Metamask.

How are prices determined?

Each pair on Energiswap is underpinned by a liquidity pool.

As mentioned above, the price of any given swap is determined by the constant product equation and the shift in ratio that the swap will cause between the pair.

What does the “Price impact too high” error mean?

Receiving an error message that reads “Price impact too high” means the price slippage incurred by your trade is too significant. You can either swap fewer tokens or add liquidity to the pool to reduce slippage.

What are the functionalities offered in Energiswap?

Energiswap provides users with the ability to swap any of the available tokens or synthetic assets listed on the exchange directly with one another.

In addition, users will be able to add liquidity to a token pair and earn a portion of the distributed swap fees. Users can also remove any liquidity that they have added at any time.

Finally, Energiswap will provide analytics for users on their swap history and the various assets available on the platform.

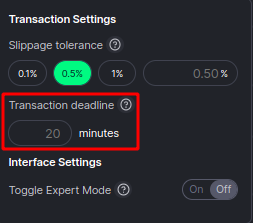

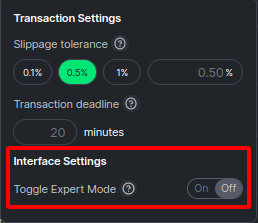

How do I adjust the transaction deadline and how does it affect the transaction?

In the top right section of the swap box is a settings symbol. Click on it and a dialog will open.

An input box will allow you to change the default of 20 minutes to any desired value. If your transaction is pending for longer than the deadline value, your transaction will revert and the swap will not be executed.

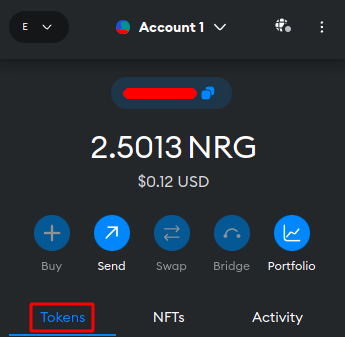

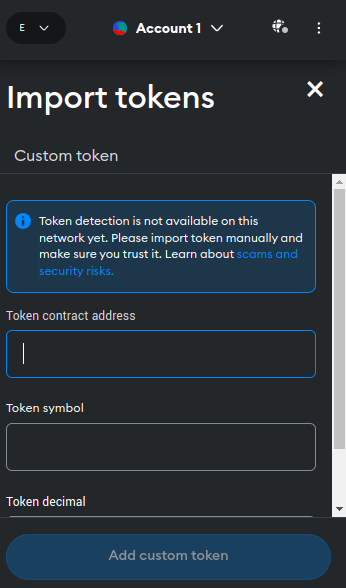

I just swapped a token, but I do not see it on MetaMask.

Select the MetaMask icon and unlock your wallet:

Select the “Tokens” tab, scroll all the way to the bottom, and select “Import Tokens”:

Paste the contract address into the “Token Contract Address” field:

If the rest of the data is not auto-populated in the other fields, fill it in as well.

Once done, select “Add custom token”, confirm the token is correct, then select “Import Tokens”. The token should now appear in MetaMask.

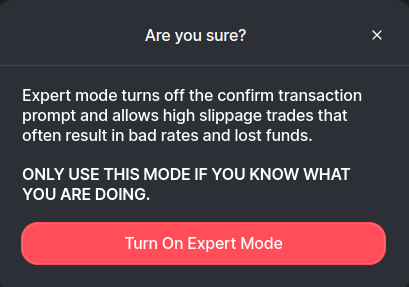

How can I toggle Expert Mode on and how will it affect transactions?

Important: Expert mode is designed for experienced users that want to execute swaps as quickly as possible to capitalize on market volatility. Expert mode disables transaction confirmation prompts and allows for much higher slippage tolerance, allowing trades to be executed much faster.

Because of the higher slippage tolerance, it is very likely that you will not receive the exact amount of the asset that you are swapping for based on current market rates.

Expert mode can be toggled on by clicking the settings icon in the top right corner of the swap box and switching the Toggle Expert Mode switch from Off to On.

After you confirm and click "Turn On Expert Mode", Expert mode will be enabled. It can be identified by a small Wizard icon below the Settings icon.

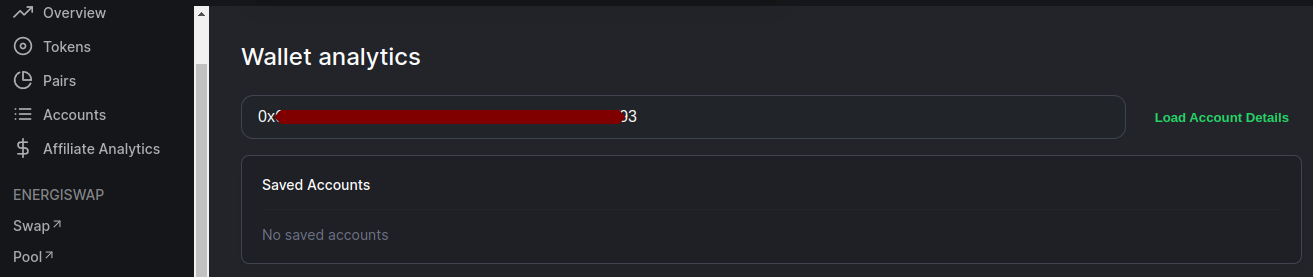

How can I see all the details related to my account?

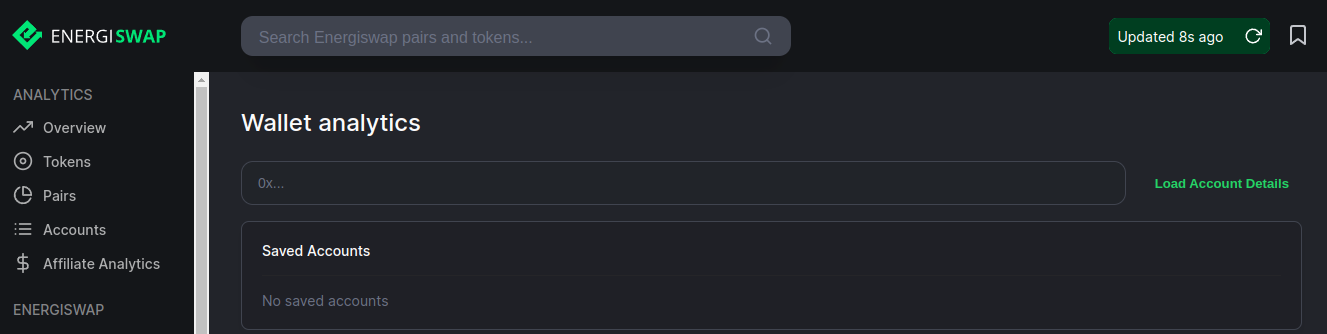

The account details for any valid NRG address can be found at https://info.energiswap.exchange/accounts.

Once you are in the Wallet analytics page, input your wallet address on the field beside "Load Account Details", and click this same button after. A new page with your account details will load.

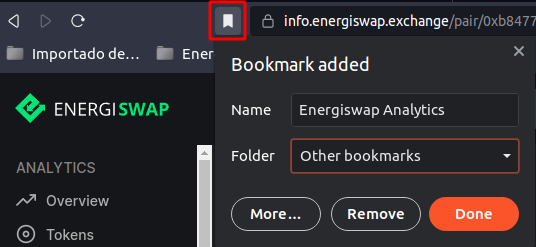

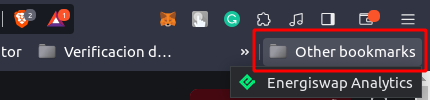

Is there a way I can easily come back to my favorite tokens/pairs?

Simply navigate to the desired view and bookmark the page in your browser.

What is Yield Farming and how can I do it on Energiswap?

Yield Farming on Energiswap allows Liquidity Providers (LP token holders) to earn passive income, in the form of NRG tokens, by staking their liquidity position (LP Tokens).

A list of available Farming Pools can be found on Energiswap: https://app.energiswap.exchange/#/farming.

What is Impermanent Loss?

Impermanent Loss can happen when the market value of the assets provided for liquidity (locked in a LP token pair) fluctuates. For instance, NRG is priced at $2 when you decide to add liquidity to the NRG-DAI pair. Let’s say you deposited 100 NRG ($200) and 200 DAI ($200) in a hypothetical pool that has a total of 1,000 NRG ($2,000) and 2,000 DAI ($2,000) made up by other liquidity providers. In such a case,you would own a 10% share of the pool.

Still, you have to keep in mind that price volatility affects the ratio of assets in the liquidity pool.

If NRG is now worth $3, arbitrage traders will remove NRG from the pool and add more DAI. While the total liquidity remains the same, the ratio between the assets in the pool will change, increasing the amount of DAI while decreasing the amount of NRG.

Since you are entitled to 10% of the pool, you will have less NRG and more DAI than you originally deposited when you decide to remove the liquidity that you provided.

It is worth noting that Impermanent Loss happens no matter which direction the price changes, as it directly impacts the asset ratio on the pool relative to the moment you provided liquidity.

Is there any way to avoid Impermanent Loss?

While Impermanent Loss cannot be fully avoided, there are a few ways to lessen its effects:

Provide liquidity to pairs which include stablecoins. These tokens tend to maintain their value because they are generally pegged to the U.S. dollar.

Use Yield Farming: https://app.energiswap.exchange/#/farming. It allows you to stake your LP Tokens and earn NRG, in addition to the fee earnings liquidity providers are entitled to.

Avoid removing your liquidity position. You can wait until the exchange rate between the pooled assets returns to the same rate when you initially provided liquidity.

How is the APY on Energiswap calculated?

The APY is earned on the full value that the LP Tokens are worth. For instance, if you have an LP token amount worth $1,000 in NRG and $1,000 in ETH, the APY considers the full amount of both assets.

We use the standard compound interest APY formula and compound over every day:

APY = (1+r/n)^n - 1, where r = period rate and n = number of compounding periods (365).

Do I earn transaction fees collected in Energiswap when I Yield Farm the LP Tokens?

Yes. You earn a portion of the transaction fees for providing liquidity in a pool while you Yield Farm the LP Tokens a given token pair.

Why do I not see my LP Tokens when I Farm?

When you Yield Farm your LP Tokens, they are locked in a smart contract. You do not have access to them during the locked up period. Once you withdraw your position from Framing, you will see your LP Tokens.

How is Farming funded?

Yield Farming is funded by the Energi Treasury.

Will a new token be released for Farming?

No, we will not release a new token. The rewards will be in NRG.